This NCLC report documents a new wave of predatory real estate lending, previously peddled to African-Americans during the 1930s to 1960s, as Wall Street investment companies move to profit off foreclosed homes. The report urges the Consumer Financial Protection Bureau (CFPB) to issue rules to protect vulnerable consumers across the nation.

Published: July 14, 2016

Published: July 14, 2016

|

|

Overview

Land contracts are marketed as an alternative path to homeownership but instead allow investors to avoid responsibility for property upkeep while churning successive would-be homeowners through a property they could not legally rent. Recently, NCLC conducted interviews with attorneys across the United States and found that land contract buyers were largely African-American, Latinos, and/or immigrants. The contracts are popular with investors because defaulting borrowers can be swiftly evicted as traditional mortgage foreclosure protections do not apply. Property owners also shift repair and maintenance costs to unsuspecting buyers who also make monthly payments in a transaction built to fail.

In 2009 (the most recent national data available), 3.5 million people were buying a home through a land contract, according to the U.S. Census. Yet the numbers may now be much higher. The report details how in recent years, large investment firms with private equity backing, some of whom profited from the subprime lending that fueled the 2008 foreclosure crisis, are using these toxic transactions to profit off of a backlog of foreclosed homes. Some of the bigger players include Harbour Portfolio Advisors, Apollo Global Management, and Shelter Growth Capital Partners. These private equity companies are pushing land contracts in states across the country, and especially in Florida, Georgia, Iowa, Minnesota, Michigan, Ohio, Pennsylvania, South Carolina, and Texas.

ATLANTA: HARBOUR PORTFOLIO LAND CONTRACT PROPERTIES ARE DISPROPORTIONATELY IN AFRICAN-AMERICAN NEIGHBORHOODS

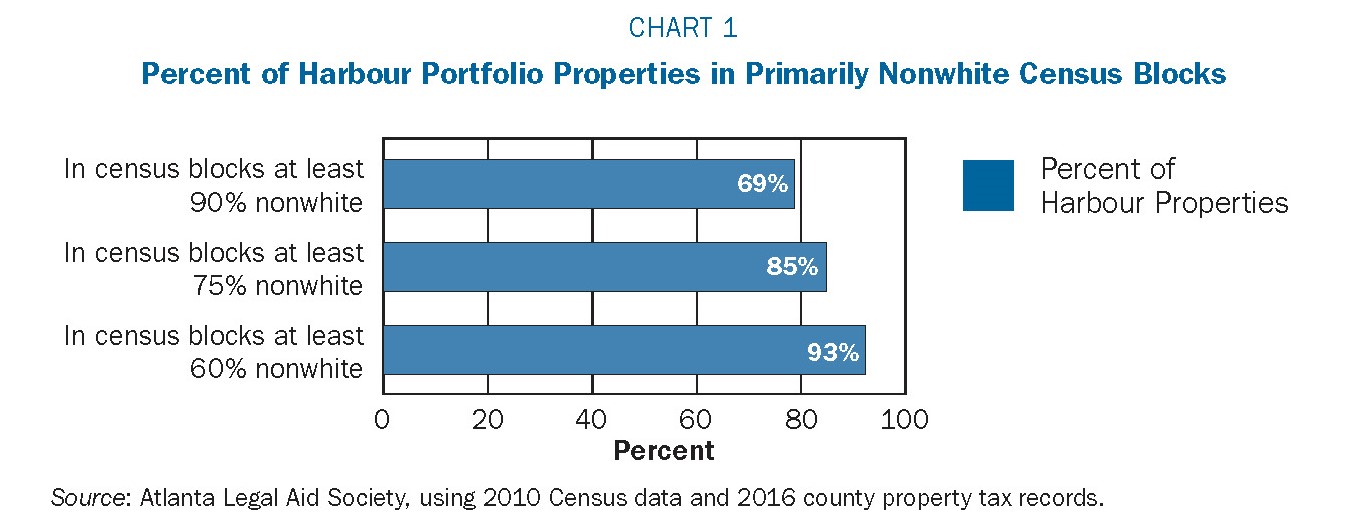

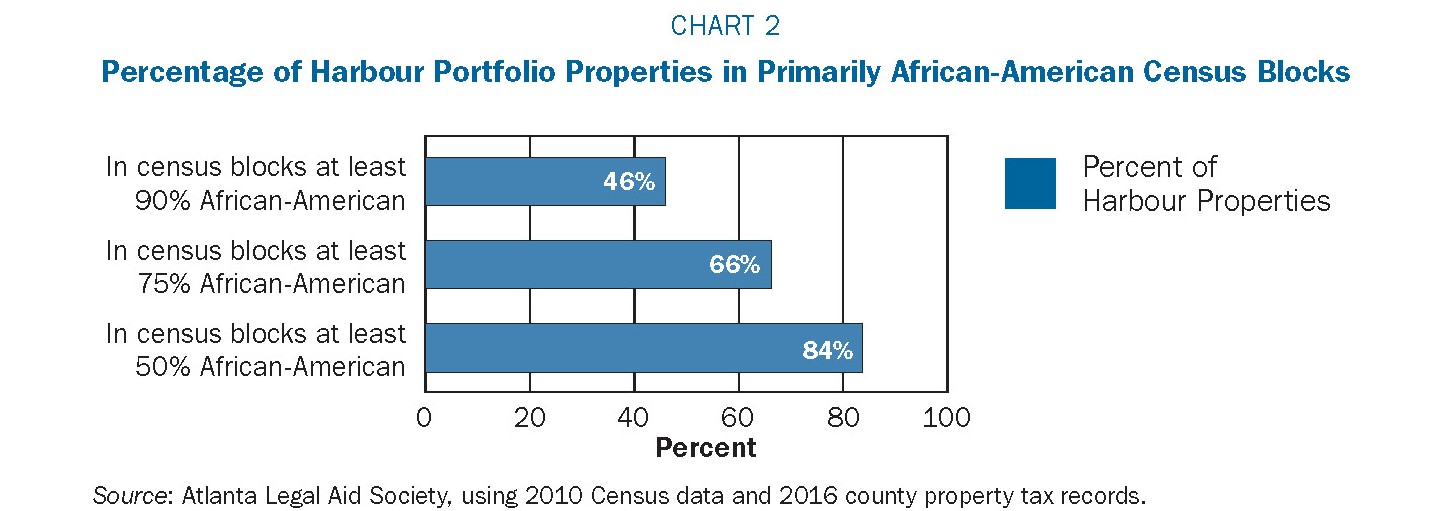

Attorneys at Atlanta Legal Aid, representing African-American clients sucked into land contracts through local advertising, found that 94 properties held by Harbour Portfolio in six metro-Atlanta counties were disproportionately located in predominantly African-American neighborhoods.

KEY RECOMMENDATIONS

States have full authority to address all of the problems with land contracts. But as land contracts are a growing nationwide problem, especially for households of color, the Consumer Financial Protection Bureau has the authority to issue a comprehensive set of rules to govern the entire land installment contract transaction. Regulation of land contracts should include:

Require an independent inspection. To prevent unfair and deceptive attempts to sell a home without disclosing its defects, an independent inspection by a licensed or certified home inspector or a governmental authority should be required before the buyer agrees to buy the home.

Require a third-party appraisal. A third-party appraisal should identify the fair market value of the home and the fair market rent, validate the inspector’s estimate of the cost of any repairs necessary to make the home habitable, and give the appraiser’s opinion of the value of the home upon completion of the repairs.

Require disclosure of the finance charge and APR. The third-party appraisal would be the basis for calculating the mark-up and disclosing the true APR. This step would address the unfair and deceptive practice of hiding the finance charge in a grossly inflated purchase price.

Require a standard form contract including key information. The seller should be required to use a contract containing the terms of the transaction, as well as the applicable law governing the transaction. States should be encouraged to create standard forms for these contracts.

Taxes and liens owed on the property must be dealt with at the time of sale. Sellers should be required to either:

a) Pay all past due property assessments before signing the contract; or

b) If the charging entity allows for payment plans, arrange for the buyer to enter into a payment plan, and then reduce the monthly land contract payment by the amount of the required property assessment payment until the assessments are paid off.

Require recordation. The seller should be required to record the contract within a short period (such as 30 days) after it is signed. The buyer should always have the right to record

the contract at any time to obtain the protections of recordation.

Provide transparency. The seller should be required to give the buyer a statement at least once a year of all amounts paid and how the payments were applied.

Right to cure or prepay. A buyer who defaults should always have a right to cure the default by paying the amount past due over a reasonable period of time (such as six to twelve months). Additionally, the buyer should be permitted to pay off the balance owed on the installment contract and acquire ownership of the home at any time, without any prepayment penalty or any further finance charges.

Provide protections for early termination—consequences of default by buyer or seller. Both the buyer and the seller should be treated fairly if the transaction falls apart.

1. If the buyer defaults but the seller has complied with its obligations, the buyer should be responsible for the fair market rent for the period of time the land contract was in effect, plus the seller’s transaction costs (the appraisal, the inspection, recording fees, etc.). However, the buyer should be credited with a) all payments made under the land contract, b) all amounts expended for necessary repairs, and c) all payments for taxes and preexisting liens. Depending on these amounts, the buyer might owe the seller a balance, or the seller might owe the buyer a refund.

2. If the seller fails to comply with its obligations (for example by failing to convey title, failing to timely record the contract, or failing to disclose or pay off preexisting liens), the buyer should be entitled to a full refund of all payments made, without owing the seller for rent or for transaction costs. This provision prohibits the abusive forfeiture clauses found in most current land contracts and creates strong incentives for sellers to comply with the regulation.

Prohibit unfair, deceptive, or abusive practices. There should be a general prohibition against unfair, deceptive, or abusive practices, applicable both during the solicitation and negotiation of the contract and during the term of the contract.

Provide documents in the buyer’s language. If the communication related to the transaction was conducted in a language other than English, then the seller should be required to provide the contract and all disclosures in that language.

Create strong enforcement. There should be strong penalties that give the seller an incentive to comply with its obligations, and the buyer should be able to enforce the seller’s obligations.

Collect data. In order to track compliance with the rule and monitor the market for new and evolving abuses, regulators should collect data on the number and location of land contracts and demographics of contract buyers. This could be done through expanding Home Mortgage Disclosure Act (HMDA) reporting requirements or by periodic sampling of property owners cross checked with county recorders offices.

CONCLUSION

The CFPB and state lawmakers have the tools at their disposal to stop predatory land contract practices before they drain further wealth from communities of color – the same communities that have already been hit hardest by the foreclosure crisis. Swift action is needed to stop the revival of an old form of financial exploitation, which threatens to trap more consumers in a mirage of homeownership – one that carries all of the burdens but none of the rewards.