This NCLC report documents the struggles of thousands of homeowners across the United States who are trying to save a home from foreclosure that they inherited or were awarded in a divorce. The report makes recommendations for how the Consumer Financial Protection Bureau (CFPB) can prevent unnecessary foreclosures for these families.

|

Additional Resources:

- “Surviving the Borrower: Assumption, Modification, and Access to Mortgage Information after a Death or Divorce,” by Sarah Bolling Mancini and Alys Cohen, Pepperdine Law Review, Vol 43: 2, February 2016

- NCLC Survey Reveals Ongoing Problems with Mortgage Servicing, May 2015

- Examples of Cases Where Successors in Interest and Similar Parties Faced Challenges Seeking Loan Modifications and Communicating with Mortgage Servicers, July 2014

- NCLC Comments to the Consumer Financial Protection Bureau (March 16, 2015) and Supplemental Comments (Jan. 26, 2016)

INTRODUCTION

One of the still-unsolved problems of the recent foreclosure crisis is the challenge faced by people who are trying to save a home that they inherited or were awarded in a divorce. Often these homeowners were not the original borrower on the loan but have lived in the house for years, or even decades. These homeowners are called “successors in interest” or “successors” because they succeed to ownership of the home after a death or family breakup.

Many times, the transfer of ownership through a death or family breakup coincides with a loss of income that causes the successor to fall behind on the mortgage payments. Often the successor needs a loan modification, to bring the loan current and adjust the payment to an affordable level, and could qualify for one under existing modification programs.

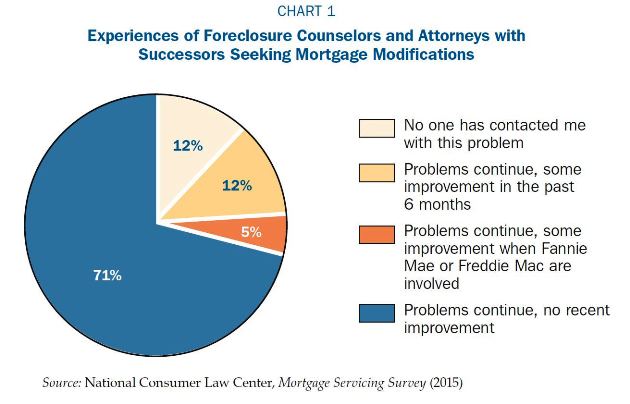

These modifications not only benefit the homeowner but also provide community stability through reduced foreclosures and vacancies, as well as financial benefit to investors through performing loans. Attorneys and housing counselors representing homeowners cite successor problems as among the most difficult problems they face as they work with homeowners to stave off foreclosure.

COMMON PROBLEMS

- The brick wall: Servicers claiming no modification is possible for a non-borrower;

- The treadmill: Servicers requesting unnecessary and nonexistent documentation of home ownership; and

- The trap door: Servicers refusing to honor modifications they have extended to a successor without the absent borrower’s signature.

In our experience, these are the three largest problems facing successors in interest. And even when successors manage to get access to account information, servicer delays result in substantially higher amounts due and eroded home equity. Qualifying for a loan modification under those circumstances is unnecessarily difficult.

Understanding these impediments imposed by servicers, and their impact on vulnerable homeowners trying to save their homes, makes it clear that the additional regulatory protections proposed by the CFPB are essential.

KEY RECOMMENDATIONS

Successors need the following six essential rules to protect their interests and reduce unnecessary foreclosures. The CFPB’s proposed rules go a long way toward meeting these policy goals, although they could be enhanced to address the needs of survivors of family violence and to better ensure servicer compliance once successors have documented their status.

- Communication. Successors need to be able to access information about the mortgage secured by their home, including monthly payment amounts, outstanding principal balances, insurance information, and payment histories. Successors should have a clear path to confirming their status and receiving loan information without having to provide documents that do not exist or cannot be produced.

- Reasonable Document Requirements. Successors need a clear path to confirming their status while servicers need to be able to rely on documented proof of a successor’s position. Clear, reasonable requirements can protect both parties while preventing the never-ending loop of document submissions. Successors only should be required to document their status as needed under state law and should not be required to face additional legal hurdles, such as opening a probate case where none is needed.

- Workouts with Assumptions. Successors facing a sudden decrease in family income need access to loss mitigation. They must be able to apply for loan modifications and be evaluated for new loan terms. In addition, successors seeking a loan modification will need to assume the loan once a modification is approved. These assumptions, however, should be processed alongside a modification. Successors should not be required to assume a loan prior to modification, as they will not know whether they will be able to afford the payments.

- Access for Domestic Violence Survivors. Successors who are domestic violence survivors face additional barriers in trying to save their homes. While many are divorced or otherwise have sole ownership of the property, some are in the process of a divorce or transfer of title. The rules must accommodate these successors, especially where there is a court order of protection, without endangering them by requiring involvement of the abuser.

- Foreclosure Protections. Like other homeowners, successors applying for hardship assistance are trying to avoid the loss of their home. Protections that pause the foreclosure process and any sale during the loss mitigation application and review period are essential, especially in light of the additional procedures successors face in proving their status.

- Enforceable Rights. Even when there are rules on the books intended to help successors obtain loan modifications, successors still run into roadblocks because servicers do not comply with those rules. The CFPB’s proposed regulations will create uniform requirements and also will promote compliance and enable successors to save their homes from unnecessary foreclosures by giving borrowers the ability to enforce those requirements. The CFPB proposal should be enhanced, however, to ensure that homeowners who document their successor status can avail themselves of the protections without delay.

CONCLUSION

It is urgent that the CFPB finalize and implement its proposed servicing rules on successors as soon as possible. The rules are an essential solution and will prevent additional unnecessary foreclosures and preserve housing stability among some of the nation’s most vulnerable families. Until strong rules are implemented, additional successor families, many already having experienced tragedy and trauma, will continue to unnecessarily lose their homes.