How the FAIR Act Enhances the Military Lending Act

The Forced Arbitration Injustice Repeal (FAIR) Act will promote accountability and transparency for a wide variety of consumer financial products and services offered to servicemembers and veterans. The bill, recently passed by the U.S. House of Representatives, allows people to band together in court and prevents companies from using fine print to take away access to the courts through forced arbitration clauses with class action bans.

The Military Lending Act (MLA) already bans forced arbitration of certain disputes. So what does the FAIR Act add to the arbitration ban in the MLA?

The FAIR Act provides essential protection for our military families and veterans (the MLA only applies to servicemembers) and covers a broader range of financial products. For example, unlike the MLA, the FAIR Act covers these areas:

- Purchase money loans, such as auto loans;

- Credit monitoring and other credit reporting services;

- Bank accounts, prepaid cards, and other noncredit accounts

- Loans before military service, such as a credit card that a servicemember still uses;

- Debt collectors and debt buyers pursuing debt not covered by the MLA; and

- Home equity lines of credit.

The MLA provides no protection in these situations that ARE covered by the FAIR Act:

- Credit bureau giant Equifax’s initial effort to block victims of its massive data breach from access to the courts through a forced arbitration clause hidden on the website for the free credit monitoring it is offering.

- Wells Fargo’s use of older bank account and credit card agreements to block lawsuits over the theft of consumers’ identity used to open fake accounts.

- Banks’ rampant violation of the Servicemembers Civil Relief Act through illegal repossession of cars while servicemembers are away on active duty, as happened to Sergeant Charles Beard and Sergeant Jin Nakamura. Beard’s attempt to bring a class action was thrown out due to a fine-print arbitration clause.

- Army soldier Prentice Martin-Bowen, who sued a buy-here-pay-here used car dealer that repossessed his car despite on-time payments, and kept two trade-in cars and the down payment. Martin-Bowen was forced into arbitration and won a small amount, but he couldn’t pay his lawyer a penny in fees and he couldn’t bring a class action to help the 100 others who suffered the same result. The arbitrator admitted that a jury would likely have awarded more.

- Wells Fargo’s illegal padding of auto loan payments with duplicative car insurance, including for servicemembers on active duty. Some contracts had arbitration clauses.

- TransUnion’s reckless mismatching of consumers, including active duty service-members serving abroad, to people with similar names on a government watch list of suspected terrorists and drug traffickers. TransUnion did not have an arbitration clause in that case, and a jury ordered it to pay $60 million ($7,337 to each class member), but the company has tried in the past to trick people into giving up their day in court.

- Army veteran Joshua Hause, who was given “no choice” and was forced to convert his existing payday loan to a 279% open-end “flex” loan that “I’ll never get out of.” A class action lawsuit over these practices was thrown out of court due to a forced arbitration clause.

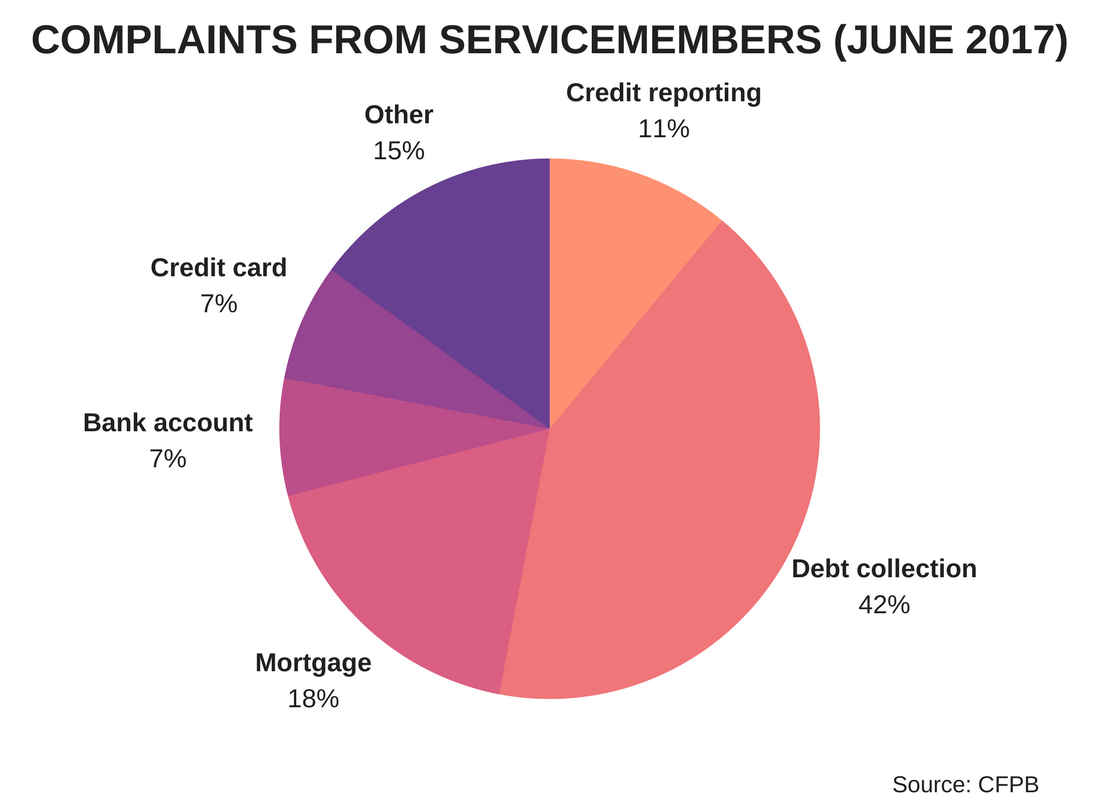

Four of the five top areas of servicemember complaints to the CFPB are not covered by the MLA. And credit cards are covered by the MLA only if they are opened by active duty servicemembers after October 3, 2017 and only while the member continues to serve.

Our men and women in uniform fight to protect our constitutional rights, including our day in court guaranteed by the Seventh Amendment. The Senate must pass the Forced Arbitration Injustice Repeal Act to restore the rights of our military.