How HUD’s Note Sale Program Deprives Homeowners of the Basic Benefits of Their Government-Insured Loans

This National Consumer Law Center report analyzes HUD’s FHA-insured loan sale program, the Distressed Asset Stabilization Program (DASP) and offers recommendations for how to make the program benefit homeowners and communities while stabilizing the FHA insurance fund. The primary beneficiaries of DASP are the large mortgage servicers that created the foreclosure crisis and the private equity firms and hedge funds that purchase the notes at a substantial discount, are the primary winners. Meanwhile, vulnerable homeowners and their communities are left to struggle with the consequences.

Published May 10, 2016 Published May 10, 2016 |

INTRODUCTION

HUD’s FHA-insured loan sale program, the Distressed Asset Stabilization Program (DASP), is the largest auctioning off of government-insured single family mortgage loans in U.S. history. Several of the major servicers (Bank of America, Wells Fargo, and JP Morgan Chase) caused the problem that DASP was created to fix by deliberately delaying foreclosures. HUD has paid off the servicers’ claims and absolved them of the problem they created while leaving homeowners and communities to struggle with the consequences.

BY THE NUMBERS

| Number of U.S. families who have obtained FHA insured loans annually since 2009: | 750,000 to 1 million |

| Percentage of African American borrowers with FHA loans in 2014: | 43% |

| Percentage of Hispanic borrowers with FHA loans in 2014: | 44% |

| Year FHA began defaulted loan sale pilot program: | 2010 |

| Year FHA ramped up the defaulted loan Distressed Asset Stabilization Program (DASP): | 2012 |

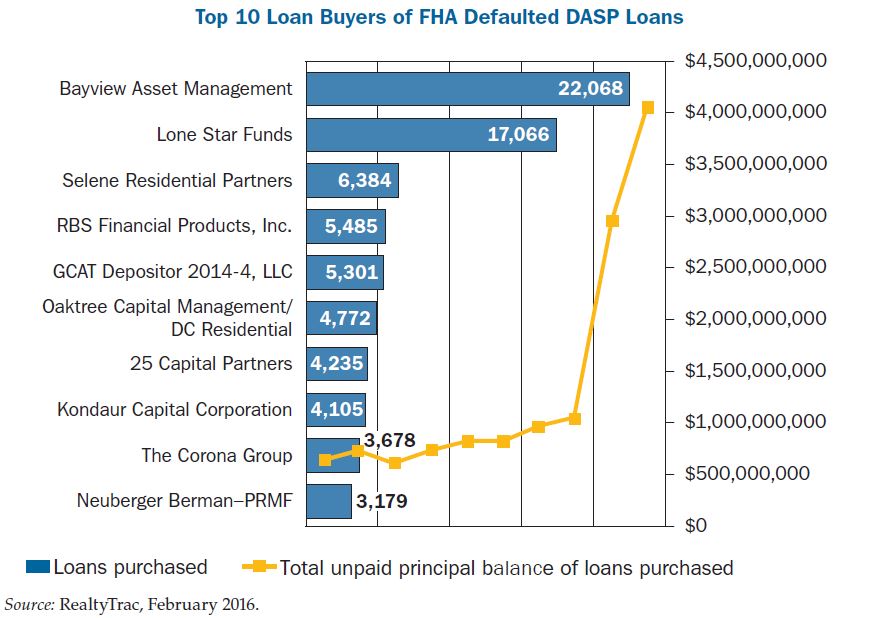

| Number of defaulted FHA loans sold from 2010 – Nov. 2015: | 105,000 |

| Number of FHA DASP loans sold in 2014: | 45,979 |

| Total value of unpaid principal balance of defaulted FHA Loans sold (2010 – Nov. 2015): | $17.9 billion |

| Average percentage of estimated market value of the properties received through DASP sales during 2014 – 2015: | 68% to 78% |

| Average percentage of estimated outstanding principal balances of loans received through DASP sales in 2014 – 2015: | 52% to 66% |

KEY FINDINGS

- HUD’s loan sale program, the Distressed Asset Stabilization Program (DASP) has had a major negative impact on vulnerable homeowners and on federal housing funds. FHA-insured mortgages represent the last recourse for middle and lower income American families, and particularly families of color, who seek to achieve homeownership at reasonable terms.

- Several large mortgage servicers, notably Bank of America, Wells Fargo, and JP Morgan Chase, caused the problem that DASP was created to fix by deliberately delaying foreclosures and HUD has not held them accountable.

- HUD failed to pursue other options for preserving the financial integrity of the FHA insurance fund, including making its servicers follow FHA’s loss mitigation rules.

- DASP undercuts state foreclosure laws that help preserve homeownership and further HUD’s housing goals.

- HUD has systematically excluded the affected homeowners from any role in the DASP loan sale process. HUD has repeatedly rejected demands that it require notices to homeowners before their loans are sold through DASP and have no idea they have lost the benefits of their FHA-insured loan.

- DASP has not helped homeowners in any significant way. HUD’s initial claims that DASP would help homeowners by allowing the buyers of the loans to offer generous loan modifications has not been substantiated by any evidence.

- HUD’s reliance on financial speculators to generate quick cash has not furthered the policy goals of the FHA program. Private equity funds and hedge funds are the primary buyers of defaulted FHA loans. These speculators’ interest is to maximize profits upon resale of the loans they buy. They do not act to further the goals of preserving homeownership for middle-class Americans, a goal that Congress directed HUD to achieve.

RECOMMENDATIONS

HUD should not conduct further FHA loan sales until it has enacted a strong and effective system for enforcement of its loss mitigation requirements and consistent, fair post-sale requirements that promote homeownership. The following recommendations will advance those two goals.

1. Enhance loss mitigation compliance by:

- Requiring servicers to document and certify compliance with each step of FHA’s sequential loss mitigation review, including documentation of the grounds for denial of foreclosure alternatives, before HUD pays a claim.

- Creating a review and appeal procedure for loss mitigation decisions using neutral decision makers.

- Imposing penalties on servicers who delay processing loss mitigation requests or systemically circumvent FHA loss mitigation requirements.

- Requiring servicers to provide notice to homeowners before a loan can be sold.

- Developing transparent and fair guidelines for determining which defaulted loans are sold.

- Promoting compliance with state and local laws, including mediation requirements.

2. Improve buyer oversight to promote homeownership by:

- Implementing a detailed loss mitigation protocol that provides top-tier loss mitigation protections to homeowners.

- Requiring that purchasers of distressed loans disclose their loss mitigation protocols.

- Implementing an effective system for homeowner appeals of servicer loss mitigation decisions after sales.

- Establishing an effective system of monitoring and enforcing loss mitigation requirements for new owners and servicers.

- Barring from future auctions buyers who have purchased FHA loans in the past but systemically violated loss mitigation standards and other program requirements.

- Requiring reporting for post-sale loss mitigation activities, including data to show the levels and nature of payment changes, and old and new borrower debt-to-income ratios.

- Mandating post-sale reporting of demographic and geographic data about homeowners, loss mitigation, and loan performance.

- Reporting data on subsequent sales and rentals involving the properties.

- Establish a clear rule that post-sale reporting requirements are binding on subsequent buyers of the loans.

- Assessing meaningful financial penalties for substantial noncompliance with reporting requirements and bidding contract terms.

- Directing the immediate public release of all post-sale management reports and supporting documentation.

- Establishing procedures to promote participation by nonprofits and mission-driven entities.

CONCLUSION

The American homeownership rate is at a 20-year low. FHA loans are the primary means for African-American and Hispanic families to achieve homeownership. The unnecessary loss of FHA homeownership forces these households to pay increasingly higher percentages of their income for rental housing, often 50% or more, while losing out on accruing wealth through homeownership. Instead of being pillars of stable communities, former homeowners must flee to wherever they can temporarily afford the rent. In a substantial number of cases, these outcomes are avoidable.

Vigorous enforcement of HUD’s loss mitigation rules would preserve homeownership and stabilize communities better than unrestricted sales of the loans, often to financial speculators.

HUD, however, has not held its major servicers accountable for their non-compliance with HUD’s own servicing rules. The mortgage servicers who caused the crisis for the FHA insurance fund walk away the winners. HUD pays the servicers’ inflated claims and they often evade state laws meant to promote sustainable homeownership.

The note sale program should only continue if it is transformed to benefit homeowners, communities, and the FHA insurance fund, while preventing FHA servicers from escaping their obligations under FHA’s rules and avoiding accountability under state law for their conduct.

Additional Resources

In many cases, the loan modifications offered by the companies purchasing loans through DASP simply delay a foreclosure for the homeowner because they are not permanent. Below are examples of loan modification agreements by or on behalf of the three largest buyers of defaulted FHA loans.

- Caliber Loan Modification Agreement (Caliber is a subsidiary of Lone Star Funds)

- Bayview Loan Adjustment Agreement (Blackstone Group is the majority owner of Bayview Asset Management)

- Selene Finance Trial Modification Plan (Selene Residential Partners is a division of Ranieri Partners)

- NCLC Policy Brief: FHA’s Distressed Asset Sale Program Should Strengthen Home Retention Goals, December 2012

- NCLC Policy Brief: FHA’s Distressed Asset Sales and Loss Mitigation Should Be Reformed to Maximize Sustainable Homeownership Solutions, Recommendations, Aug. 31, 2012