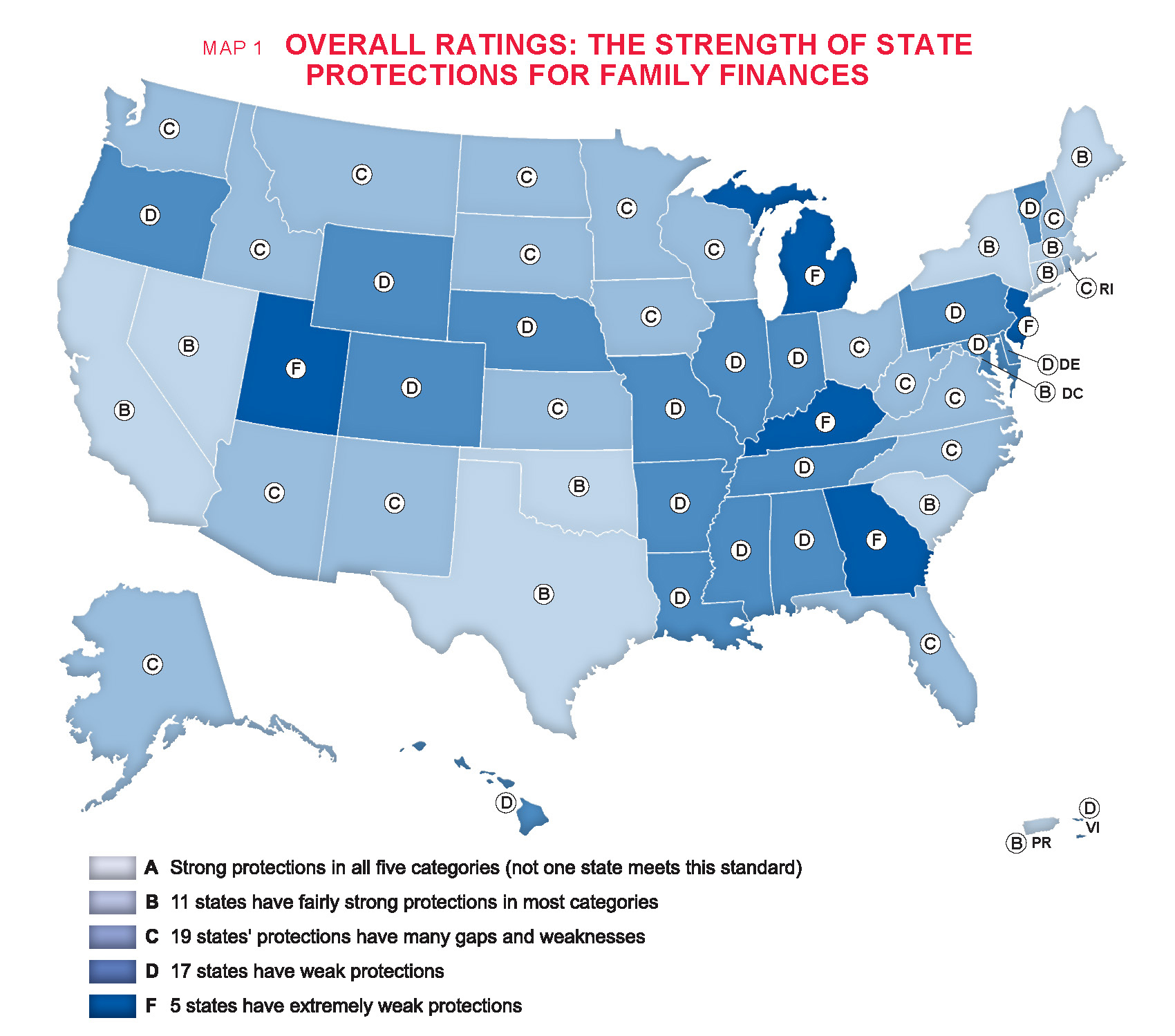

Every state has a set of exemption laws, intended to prevent creditors from pushing families into destitution. But NCLC’s No Fresh Start 2021 report finds that few states’ exemption laws meet even the most basic standards. With weak exemption laws, families struggling to get back on their feet after the COVID-19 pandemic will face seizure of wages and essential property due to a wave of debt collector lawsuits. Weak exemption laws will impede economic recovery and exacerbate the racial wealth gap.

Published: November 10, 2021

©National Consumer Law Center, Inc.

- Report (Web) | Report (PDF)

- Key Recommendations

- Appendix A (Rating Criteria)

- Appendix B (State Summaries)

- State Maps

- Tables

- Press Release

- Related

- Model Family Protection Act (model law language)

- Protecting Wages, Benefits, and Bank Accounts from Judgment Creditors (NCLC Digital Library article)

Key Recommendations

State exemption laws should be reformed to:

- Protect a living wage from seizure by creditors.

- Automatically protect a reasonable amount of money on deposit so that families can meet several months of basic needs such as rent, daycare, utility bills, and commuting expenses.

- Preserve the debtor’s ability to work, by protecting a working car, work tools and work equipment.

- Protect the family’s housing and necessary household goods.

- Protect retirees from destitution by restricting creditors’ ability to seize retirement funds.

- Be automatically updated for inflation.

- Close loopholes that enable some lenders to evade exemption laws.

- Be self-enforcing to the extent possible.

This report builds on NCLC’s advocacy, training, publications, and public policy work on fair debt collection to promote family financial well-being. Learn more

Model Family Financial Protection Act:

NCLC has written model language for states to achieve these goals. The model law also includes

steps that states can take to reduce the pervasive abuse of the court system by debt buyers.

Related Publications

- Wage Garnishment for Consumer Debts: Reforms Needed in the Current Covid Crisis and Beyond

- Coronavirus Emergency: Consumer Debt Collection Lawsuits – How States Can Help

- The Debt Machine: How the Collection Industry Hounds Consumers and Overwhelms the Courts (July 2010)

- What States Can Do to Help Consumers: Debt Collection, May 2019

- State Debt Collection Fact Sheets, 2018

- For attorneys: Fair Debt Collection and Collection Actions

- For consumers: Surviving Debt (personal finance book) and Consumer Debt Advice (free articles)