How Does the Prepaid Card Rule Protect Workers?

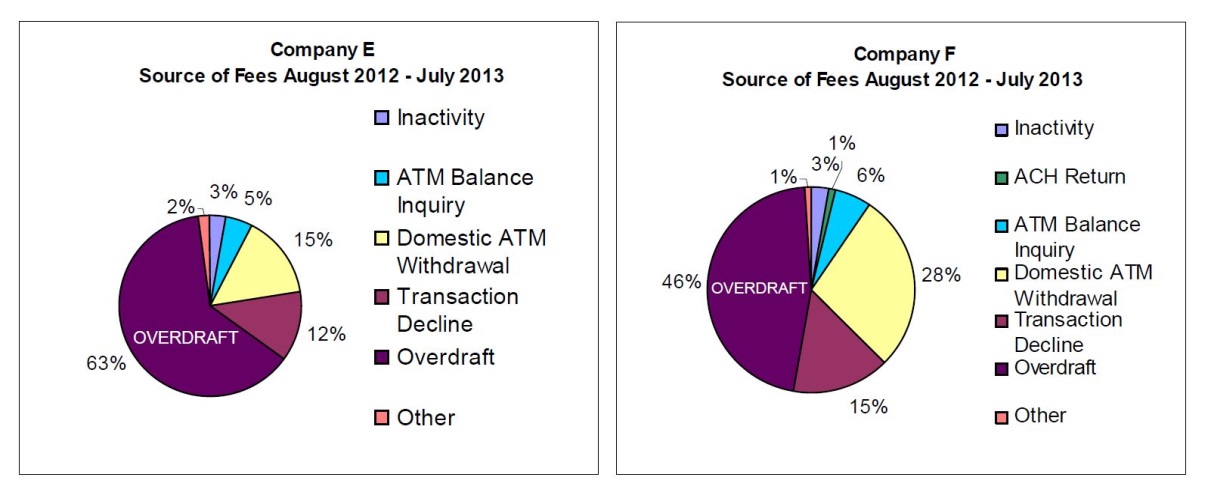

For workers without bank accounts, payroll cards can be a safe, fast and convenient way to receive pay. But some employers have illegally coerced workers into accepting wages on payroll cards. Cards can be loaded with fees that drain thin wages — including overdraft fees, which make no sense on accounts without checks that can overdraft. A survey by the New York Attorney General found that two payroll card programs earned 46% and 64%, respectively, of their revenue from overdraft fees. At one employer, workers paid an average of $77.82 in overdraft and declined transaction fees.

The CFPB’s prepaid card rule:

- Gives workers a simple chart of fees before they select how to receive their pay;

- Warns employees that they are not required to accept a payroll card;

- Protects employees from high, unaffordable overdraft fees on payroll cards.

This common-sense rule will benefit not only consumers but also banks, credit unions, and employers that offer low-fee cards or are asked to cash payroll cards from other companies.

Who Opposes the Prepaid Card Rule?

NetSpend, the only major prepaid card company with overdraft fees, opposes the rule. NetSpend expects to lose $80-$85 million in overdraft and other fees. Employees who opt in to overdraft “protection” on NetSpend’s “Skylight” payroll cards pay a $25 overdraft fee on if a purchase overdraws the card more than $5, with up to $125 in overdraft fees each month. NetSpend imposes a “cooling off” period after $450 in overdraft fees in 12 months.

Skylight payroll cards are used in industries with minimum wage workers who may not have full time jobs, including fast-food and other restaurants (Church’s Chicken, KFC, Long John Silver, Pizza Hut, Taco Bell, White Castle, Cracker Barrel, Friendly’s, Frisch’s, Houilhan’s); retail stores (Big Lots, Coach Leatherware, DSW, Haverty’s, Kohl’s, Liz Clairborne, Macy’s, Office Max, Payless, Shaw Flooring, SuperValu, The Limited, Valvoline); hotels (MGM Mirage and Starwood); health care providers (Hospital Corp. of America, LifePoint Hospitals, Inc., Cleveland Clinic); Kansas and Missouri State governments; and public schools (Denver Public Schools, Miami-Dade Public Schools).

Congress Should Not Undo Protections for Employee Payroll Cards.