How Dealer Discretion Drives Excessive, Inconsistent, and Discriminatory Pricing

This groundbreaking National Consumer Law Center analysis of a large national data set unlocks the door on what car dealers pay for auto add-on products and what they charge consumers. Pricing of these optional products involves large mark-ups and arbitrary and discriminatory pricing for consumers.

| Report (PDF)

Charts & Graphics (PDF) |

Executive Summary

Add-on products sold by car dealers, such as service contracts, Guaranteed Asset Protection (GAP) insurance, and window etching, make up a large share of dealers’ profits. They also significantly increase car buyers’ costs. While many have questioned the value of these products for consumers, the pricing of these products has received less attention, largely because pricing is not transparent. Even regulators lack information about what car buyers pay for these products. Dealers decide what to charge each consumer and generally only the dealer, the finance company, and the third party provider of the add-on ever know what other consumers are paying. This National Consumer Law Center analysis of a large national data set is a revealing first look at what dealers pay for auto add-on products and what they charge consumers.

Key Findings

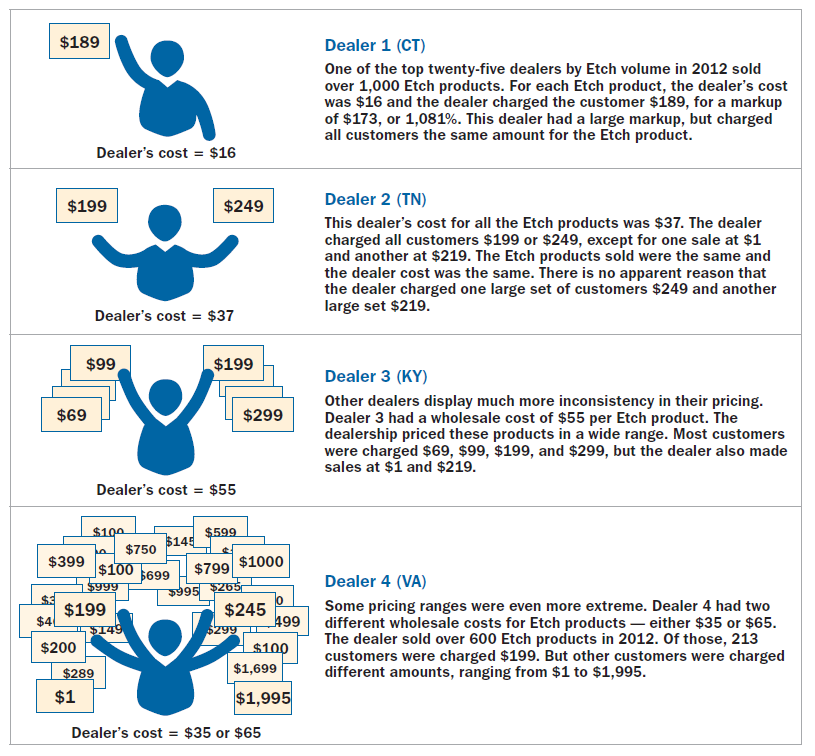

- Add-on products are sold at prices far higher than dealer costs. Dealers mark up add-on products more than other similar products are marked up. They mark up add-on products by a far higher percentage than they mark up cars. One dealer sold over 1,000 window etching products, each with a dealer cost of $16 and a charge to the consumer of $189, for a markup of $173 or 1,081%. For Guaranteed Asset Protection (GAP) insurance products, 38 dealers had average markups of 300% or more, and 38 dealers marked up service contracts by an average of more than 300%.

- Dealers are inconsistent in the pricing of add-on products. Individual dealerships charge some consumers many times more than other consumers for the same product with the same dealer cost.

Dealers and Window Etching Pricing

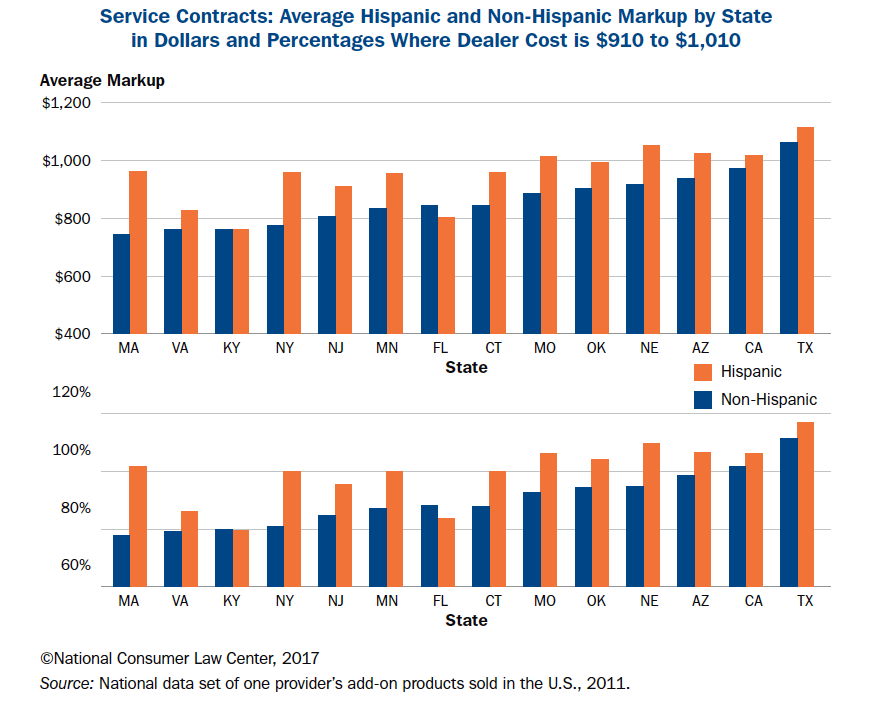

- This inconstant pricing for the same add-ons leads to pricing discrimination, with Hispanics charged higher markups than non-Hispanics.

- Companies that provide car financing play an important role in allowing excessive and discriminatory markups of auto add-ons.

These abuses, damaging enough in themselves, set in place a chain of other consequences for consumers. The expensive add-ons increase the price of cars, putting them out of reach for some consumers.

They also increase the loan to value (LTV) ratio for cars, as they increase the amount that consumers finance without providing any real increase to the value of the car. These higher LTVs result in more negative equity, which hurts consumers and other players in the auto sales and finance market because a consumer who owes more than his or her existing car is worth will have a hard time trading it in and buying a new car. High LTVs have also been associated with higher default rates, again harming consumers and the industry as a whole.

Recommendations

- Dealers should be required to post the available add-ons and their prices on each car in the lot, along with the price of the car. To prevent the dealer from reintroducing non-transparency by offering discounts to some customers but not others, the prices for the add-on products must be non-negotiable.

- To root out pricing discrimination, the federal Equal Credit Opportunity Act regulations should be amended to require documentation of the customer’s race or national origin for non-mortgage credit transactions, as is currently required for home mortgage transactions. If discrimination remains hidden, it will not be possible to end it.

- State and federal enforcement authorities should investigate discrimination in pricing of add-on products and bring enforcement actions against a dealer if discrimination is shown. The Consumer Financial Protection Bureau, the Federal Trade Commission, the Federal Reserve Board, and state attorneys general all have authority in this area.

Learn more about the National Consumer Law Center’s work on consumer auto sales and financing and NCLC’s Working Cars for Working Families project.

Consumer Credit Regulation Consumer Credit Regulation |

Consumer Warranty Law Consumer Warranty Law |

Unfair and Deceptive Unfair and DeceptiveActs and Practices |

Automobile Fraud Automobile Fraud |